Discussing money and budgets in adult ESL classrooms works because it’s a topic that affects everyone’s daily lives, regardless of language or cultural background. Understanding budgeting, saving, investing, and debt management can significantly impact their financial well-being. After all, money can’t buy happiness, but it can buy you the freedom to pursue it.

By discussing money matters in the classroom, adult ESL students can learn to communicate more effectively about financial issues, leading to greater financial literacy and success. Plus, with the rising cost of living and the challenges of managing personal finances, money and budgets will always be a timely topic relevant to adult ESL students.

Cash, Credit, and Confidence: The Benefits of Discussing Money and Budgeting in an Adult ESL Classroom

Money is a universal language, and becoming fluent in it can make a world of difference in one’s life. However, for many adult ESL students, navigating financial matters in a new language and culture can be tough. Let’s go over a few reasons why you might want to add money and budgeting as a relevant topic to discuss in your adult ESL classes.

- Practicality: Money and budgeting is an everyday topic that adults encounter in their personal and professional lives. Why wouldn’t we want to equip them with the language they need to understand and manage their finances more effectively? You don’t have to make your class centered on developing financial literacy, but getting your students set up to talk about finances comfortably can prepare them for any financial literacy class they may want to take in the future.

- Empowerment: Learning about money and budgeting empowers your students to make informed financial decisions. It gives them the tools to plan for their future and achieve their financial goals, such as buying a house, starting a business, or saving for retirement. But asking questions is tough when you don’t know what you don’t know. Fortunately, as adults, your ESL students often have a wealth of personal experience and expertise they could share with their classmates.

- Cross-cultural communication: Money and budgeting are universal topics that transcend cultural and linguistic boundaries. By discussing these topics in the classroom, your adult ESL students can improve their ability to communicate with people from different backgrounds and understand cultural nuances related to financial matters.

Show Me the Money: Engaging Strategies for Making Money and Budgeting Part of Discussions in Adult ESL Classes

Discussing money and budgeting in the classroom can be intimidating, and knowing where to start is not always easy. Plus, incorporating these topics into your classroom discussions can be challenging, particularly if your students have varying levels of English proficiency and financial literacy. Let’s explore some strategies for making money and budgeting a successful topic of discussion in your adult ESL classes to help your students practice their English while perhaps also improving their financial literacy.

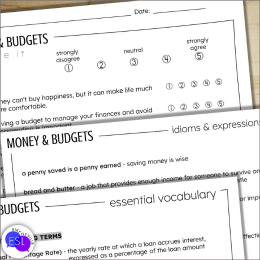

Vocabulary building: Start by building their financial vocabulary to enable them to understand and discuss money and budgets. You can give them a list of key financial terms and expressions, such as savings, interest, budget, credit score, and investment, and teach them their meanings and usage. Use more accessible words and definitions for your lower-level students and give your more advanced students those higher-level words.

Role-playing exercises: Simulate real-life financial scenarios with role plays to get the discussion rolling. For example, you can have your adult ESL students act out scenarios related to money and budgets, such as opening a bank account, applying for a loan, negotiating a salary, or buying a car. Then give them some discussion prompts to let them dive deeper.

Group discussions: Group discussions effectively encourage your adult ESL students to share their thoughts and ideas on money and budgets. Use open-ended questions to initiate discussions on budgeting, saving, investing, and debt management, and encourage them to express their opinions and ask questions.

Overcoming Challenges and Implementing Effective Solutions for Using Discussions about Money and Budgets in Adult ESL Classes

Using money and budgets as a discussion theme can effectively engage your adult ESL students, but it’s not without its challenges. Cultural differences, limited prior knowledge, and language barriers are just a few of the challenges you may encounter. So let’s examine those possible challenges and talk about strategies for implementing solutions that can lead to greater success.

CHALLENGE: limited prior knowledge

Some of your adult ESL students may have limited prior knowledge or experience with financial matters, making it challenging for them to understand and engage with financial concepts. So what do you do?

Well, start by assessing their prior knowledge and experiences with financial matters and building on what they already know. Then use real-life examples and scenarios that your adult ESL students can relate to and help them understand the relevance of financial concepts in their daily lives.

One way I like to accumulate real-life examples is by building a pool of ready models when I listen and take notes during student discussions. When I come across a particularly good one, I get permission from the student involved and save it for use in future classes. These tend to be more relevant than anecdotes based on my family and friends.

CHALLENGE: cultural differences

Cultural differences can affect your adult ESL students’ attitudes and beliefs toward money and budgets, making it challenging to teach financial concepts that may not align with their cultural norms. How can culture play a part in that? Here are a few examples:

- Views on Collectivism vs. Individualism: In some cultures, individuals may focus more on their responsibility to their family or community than on their financial success. This can lead to differing views on saving, investing, and spending.

- Relationship with Authority: In some cultures, there may be greater respect for authority figures such as bankers or financial advisors, while in others, there may be more skepticism towards these individuals or institutions.

- Attitudes towards Debt: Some cultures may view debt as a necessary part of life, while others may view it as something to be avoided at all costs.

- Attitudes towards Risk: Some cultures may value risk-taking and entrepreneurship, while others may be more risk-averse and conservative in their financial decision-making.

- Gender Roles: In some cultures, there may be distinct gender roles when it comes to managing finances, which could affect how your students approach financial concepts.

- Time Orientation: Some cultures may prioritize short-term goals, while others may place greater emphasis on long-term planning and delayed gratification.

Use culturally sensitive teaching strategies and materials that consider their cultural norms and attitudes towards money and finances. Encourage your adult ESL students to share their perspectives and experiences. This can lead to cross-cultural understanding and enhance their engagement.

CHALLENGE: limited language proficiency

Some of your adult ESL students may have limited English language proficiency, making it challenging for them to understand financial vocabulary and concepts. Does that mean you can’t talk about money and budgets? MAYBE. That’s your call. But to make it more accessible to your lower-level students, use simplified language and visual aids such as charts, graphs, and diagrams to explain financial concepts. You can also provide opportunities for them to practice and use financial vocabulary in context, such as role-playing exercises and group discussions that are at their proficiency level (or a tad beyond).

CHALLENGE: complex concepts

Financial concepts such as investment, taxes, and insurance can be complex and challenging to explain, making it difficult for you to present them in a way that is easily understandable for adult ESL students.

Just like you move a mountain one shovelful at a time, you’ll need to break down complex financial concepts into simpler parts. Try using real-life examples and scenarios to illustrate them. You can also provide access to online resources and materials that can help them deepen their understanding of financial concepts.

Or, don’t go that deep. If your class is more focused on practicing English than becoming proficient in financial literacy, stick to what’s appropriate to their level.

CHALLENGE: personal biases

You may (probably) have personal biases or beliefs that could affect how you present financial concepts, making it challenging to present an objective perspective that is inclusive of all your students. I know I have a problem not coming across as heavy-handed with my extreme frugalism. But because I’m aware of it, I can keep an eye on myself and be intentional about how I speak.

Adopt an objective and inclusive perspective when talking about money and budgets, and be open to their diverse perspectives and experiences. If money and budgeting is a theme you’ll be spending a lot of class time on, consider seeking professional development opportunities to enhance your understanding and teaching of financial concepts. It doesn’t have to be a paid college course–you could probably find something that suits you on YouTube.

Final Thought

Before you dive too deep into a money pit, find out where their knowledge gaps are and where their financial interests are. Conduct a needs analysis to assess their prior knowledge and experiences with money and budgets, as well as their specific financial literacy needs and goals. Need something to get started on that? Subscribe to my newsletter, and I’ll give you one for free!

Leave a Reply